Did you know that in many Latin American countries you can legally import products from Japan without paying customs duties or taxes? Thanks to “de minimis” exemption laws in countries like Colombia, Costa Rica, and the Dominican Republic, it’s possible to receive Japanese goods —such as tech, game consoles, cosmetics, or gadgets— with no extra cost and no legal risk.

This guide explains, step by step, how to take advantage of this benefit, which shipping services to use, and what value limits to respect to make sure your purchases from Japan remain tax-free, economical, and safe. Everything is backed by legal and technical evidence — so you’re not just saving money, you’re doing it right.

📦 Why some products from Japan are exempt from taxes in Latin America

Most Latin American countries apply a customs rule known as the “de minimis regime”. This law exempts international shipments from taxes and import duties as long as the total shipment value (including product, shipping, and insurance) does not exceed a certain legal limit.

That limit varies by country. As of 2025, here are some real-world examples:

Costa Rica: Up to USD 500 without taxes.

Colombia and the Dominican Republic: Up to USD 200 if using a registered courier.

Peru and Ecuador: Between USD 200 and 400 with full exemption.

This benefit applies whether the product is shipped directly from Japan or first goes through the United States via a forwarding service — as long as the final leg of the shipment complies with your country’s customs rules.

📚 Official References:

SIECA – Customs integration studies for Central America

International forwarding service regulations (Shipito, MyUS, DHL Express)

DIAN (Colombia) – Decree 1165 of 2019 on express shipments

DGII (Dominican Republic) – Courier registry for ITBIS exemption

SUNAT (Peru) – Simplified personal import system

📊 Duty-Free Import Thresholds (De Minimis) in Latin America – 2025

| Country | Tax-Free Threshold | VAT or Additional Tax | Key Notes |

|---|---|---|---|

| Mexico | 50 USD (mail) / 117 USD (courier) | Yes (16% VAT) | Common with forwarding services |

| Argentina | 50 USD per shipment (max 12/year) | Yes (50% on excess) | AFIP registration required |

| Chile | 30 USD (state mail) | Yes (19% VAT) | VAT law applies to digital imports |

| Colombia | 200 USD | Yes (19% VAT if exceeded) | Duty-free under 200 USD |

| Peru | 200 USD | Yes (18% IGV if exceeded) | Frequent use of forwarders |

| Ecuador | 400 USD | Yes (VAT + duties on some items) | Especially electronics |

| Uruguay | 200 USD (3 shipments/year) | Yes (22% VAT) | Managed by Correo Uruguayo |

| Paraguay | 100 USD | Yes (10% VAT) | Duty-free only up to 100 USD |

| Bolivia | 100 USD | Yes (VAT and duties) | Same rules for forwarding |

| Brazil | 50 USD (only private sender) | Yes (ICMS + import tax) | Stores pay full tax even under 50 USD |

| Venezuela | 100 USD | Yes (VAT + duty) | Registered couriers required |

| Cuba | 30 USD or 1.5 kg | Yes (point-based system) | Very restrictive |

| Dominican Republic | 200 USD (registered couriers) | Yes (18% ITBIS) | Exempt if listed with DGII |

| Honduras | 50 USD | Yes (15% VAT) | Duty-free only if under limit |

| Guatemala | 100 USD | Yes (12% VAT) | Invoices required at customs |

| El Salvador | 200 USD | Yes (VAT + duty if exceeded) | Forwarders commonly used |

| Nicaragua | 100 USD | Yes (15% VAT) | Same as neighbors |

| Costa Rica | 500 USD | Yes (13% VAT) | Highest tax-free limit in LATAM |

Table based on official customs data and de minimis regulations across Latin America. Updated for 2025.

IMPORTANT

In Colombia and the Dominican Republic, the de minimis exemption only applies if the package is delivered by a courier or freight forwarder officially registered with the national tax authority.

In contrast, countries like Costa Rica, Peru, and Ecuador do not require a registered service to apply the benefit, although it is strongly recommended to use a reputable company to avoid customs delays or misreported declarations.

Can I ship from Japan to the U.S. via regular mail, then to Colombia or the Dominican Republic using a registered courier to reduce costs?

Yes, but only if you meet these conditions:

Do not consolidate too many items.

In some countries, if you combine several purchases into one shipment, you may exceed the de minimis even if each item alone is under the limit.

You must use a recognized forwarding or mailbox service.

Examples: Shipito, Stackry, MyUS, Buyee, Tenso, etc. These companies receive your purchase in the U.S. and then forward it to your country using a registered courier (like DHL, FedEx, UPS).

The final courier (U.S. to your country) must be registered locally.

It must be properly documented.

The package must declare the correct total value (product + shipping).

The invoice must match the declared amount.

The courier is responsible for filing the proper customs declaration to activate the de minimis benefit.

Even from Argentina, importing from Japan makes sense

This analysis shows that even in the country with the lowest duty-free threshold and highest import taxes, importing Japanese tech is possible, legal, and significantly cheaper if done strategically.

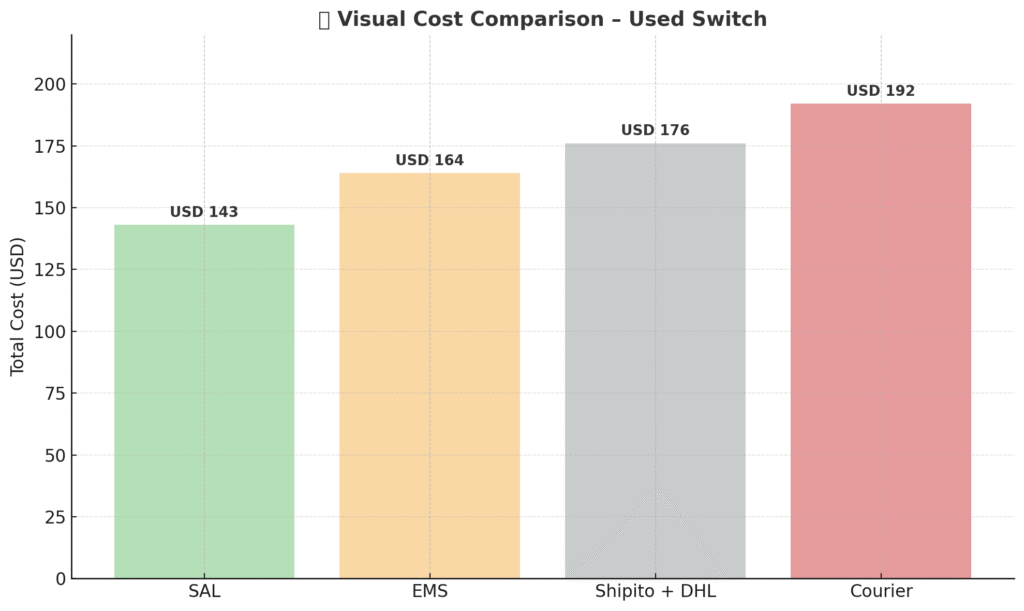

🎮 Nintendo Switch Used – Shipping Strategy Comparison

| Shipping Method | Purchase Price | Shipping Cost | Tax (50% over USD 50) | Total Estimated Cost |

|---|---|---|---|---|

| Japan Post SAL | USD 100 | USD 12 | USD 31 | USD 143 |

| Japan Post EMS | USD 100 | USD 26 | USD 38 | USD 164 |

| Shipito + DHL | USD 100 | USD 34.50 | USD 42.25 | USD 176.75 |

| Direct Courier | USD 100 | USD 45 | USD 47.50 | USD 192.50 |

*Assuming declared value is USD 100 and tax applies over USD 50 at 50%.

Visual comparison of shipping options for used Nintendo Switch (based on declared value of $100 and applicable taxes in Argentina).

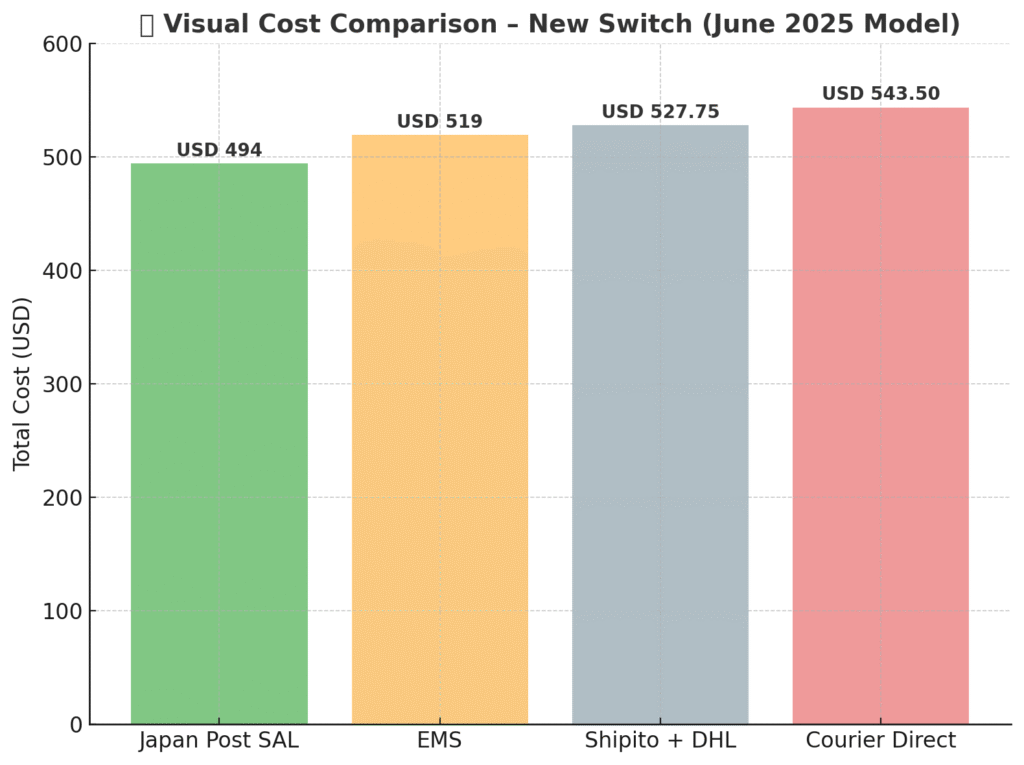

🆕 Nintendo Switch (2025) – Shipping Strategy Comparison

| Shipping Method | Purchase Price | Shipping Cost | Tax (50% over USD 50) | Total Estimated Cost |

|---|---|---|---|---|

| Japan Post SAL | USD 334 | USD 12 | USD 148.00 | USD 494.00 |

| Japan Post EMS | USD 334 | USD 26 | USD 155.00 | USD 519.00 |

| Shipito + DHL | USD 334 | USD 34.50 | USD 159.25 | USD 527.75 |

| Direct Courier | USD 334 | USD 45 | USD 164.50 | USD 543.50 |

*Assuming declared value is USD 334 and tax applies over USD 50 at 50%.

Visual comparison of shipping options for New Nintendo Switch Japanese version (based on declared value of $334 and applicable taxes in Argentina).

📊 Data Insight: Importing Isn’t an Exception — It’s a Viable Strategy

The figures presented above do more than highlight a price difference — they reveal a structural market distortion across Latin America. While the price of a new console in Japan remains close to its official retail value, in countries like Argentina it increases by up to 130% due to currency restrictions, import barriers, and reseller markups.

The fact that a used Nintendo Switch imported from Japan can cost as much as USD 400 less than its local equivalent proves that importing isn’t just feasible — it’s rational. Crucially, this price gap persists even after accounting for international shipping, taxes, and forwarding service fees.

This is not a fringe solution. It confirms that informed consumers now have real tools to access premium tech, avoid domestic inflation traps, and buy legally without falling into abusive overpricing.

Global market dynamics are shifting. With the right approach, importing Japanese products through reliable, well-managed channels is becoming a sustainable and strategic option for Latin American buyers.

🔧 Warranty & After-Sales Support: What If the Product Fails?

One of the most frequent concerns when importing technology from Japan is what happens if the product needs repair. The answer is clear: the manufacturer’s warranty remains valid in Japan because the purchase was made within its jurisdiction. What doesn’t exist is an obligation to offer support in the buyer’s country, especially when the brand operates locally through different authorized channels.

Buyers can send the product back to Japan for warranty repairs, covering the shipping costs. In many cases, this is still a cost-effective option, especially when the price difference compared to local retail is substantial.

In countries like Argentina, this process is entirely legal thanks to the temporary export regime for re-importation in the same condition, as defined in Articles 349–373 of Argentina’s Customs Code (Law 22.415). This allows a product to leave the country for repair and return without new import duties, provided the following conditions are met:

- 📄 A customs declaration must be submitted in advance to the Dirección General de Aduanas (DGA).

- 📦 The product must be returned within the authorized period (typically up to 360 days).

- 🔧 It must be re-imported in the same condition as it was exported, except for the repair performed.

- 🛃 Supporting documentation for both export and repair must be provided upon re-entry.

In summary: Japanese warranty is not lost — it simply has to be handled through the original country. For strategic buyers, even covering international shipping can be a smart move compared to inflated local prices and limited availability in the region.

💡 Smart Legal Importing: Key Tactics for Latin America

💡 Smart Legal Importing: Key Tactics for Latin America

If you’re shopping from Latin America and want to avoid unnecessary import duties, here’s how to do it legally while still accessing the best deals Japan has to offer:

- 👉 Choose used or refurbished items on Amazon Japan or Mercari. These are often eligible for international shipping and usually fall under lower-value thresholds, making customs clearance easier.

Explore Japan’s ‘Renewed’ Market

As mentioned, choosing refurbished items is a key tactic for cost-effective importing. Our companion portal, Discover Renewed, specializes in curating and guiding you through Japan’s extensive market of ‘Renewed’ products, from tech to collectibles.

Visit Discover Renewed- 👉 Use forwarding services such as Buyee, ZenMarket, or White Rabbit Express. These allow you to buy domestic-only products using a Japanese address and ship them internationally. This method is essential when the item is restricted from direct global shipping.

(For a detailed, real-world example, see how this method is applied in our console buying guide.) - 👉 Understand how Japan’s 10% consumption tax exemption works. Most Japanese websites, including Amazon, display prices with tax included. If you ship directly to your country during checkout, the 10% tax is typically removed at the final step. However, when using a forwarding service, the purchase is made with a Japanese address — so the tax will be applied. Even so, this approach gives you access to thousands of exclusive or domestic-only products.

- 👉 Always declare the real value and know your country’s de minimis threshold. Many Latin American countries still allow duty-free imports for low-value shipments when properly declared.

- 👉 Don’t assume Amazon Japan ships everything internationally. While it does ship some items abroad, the catalog is extremely limited. Most serious buyers use forwarders to unlock the full domestic inventory.

- 👉 This strategy applies to much more than consoles. Whether you’re buying tech, skincare, watches, collectibles, or everyday accessories — new or used — the same system applies. With smart planning, the only limit is your creativity.

🔗 Recommended reading: Full buying guide for consoles from Japan – Nintendo & PS5 (2025)